This post contains affiliate links. We may earn compensation when you click on the links at no additional cost to you.

Being our own boss is one of the best things we have ever done to better our lives and enriching our family time. Being self-employed means long hours and determination to push through the highs and lows, but it also means that the sky is the limit when it comes to adventures and your earning potential. Thanks to our friends at Intuit for sponsoring this post.

We learned pretty quickly that the name of the game was work hard and play even harder.

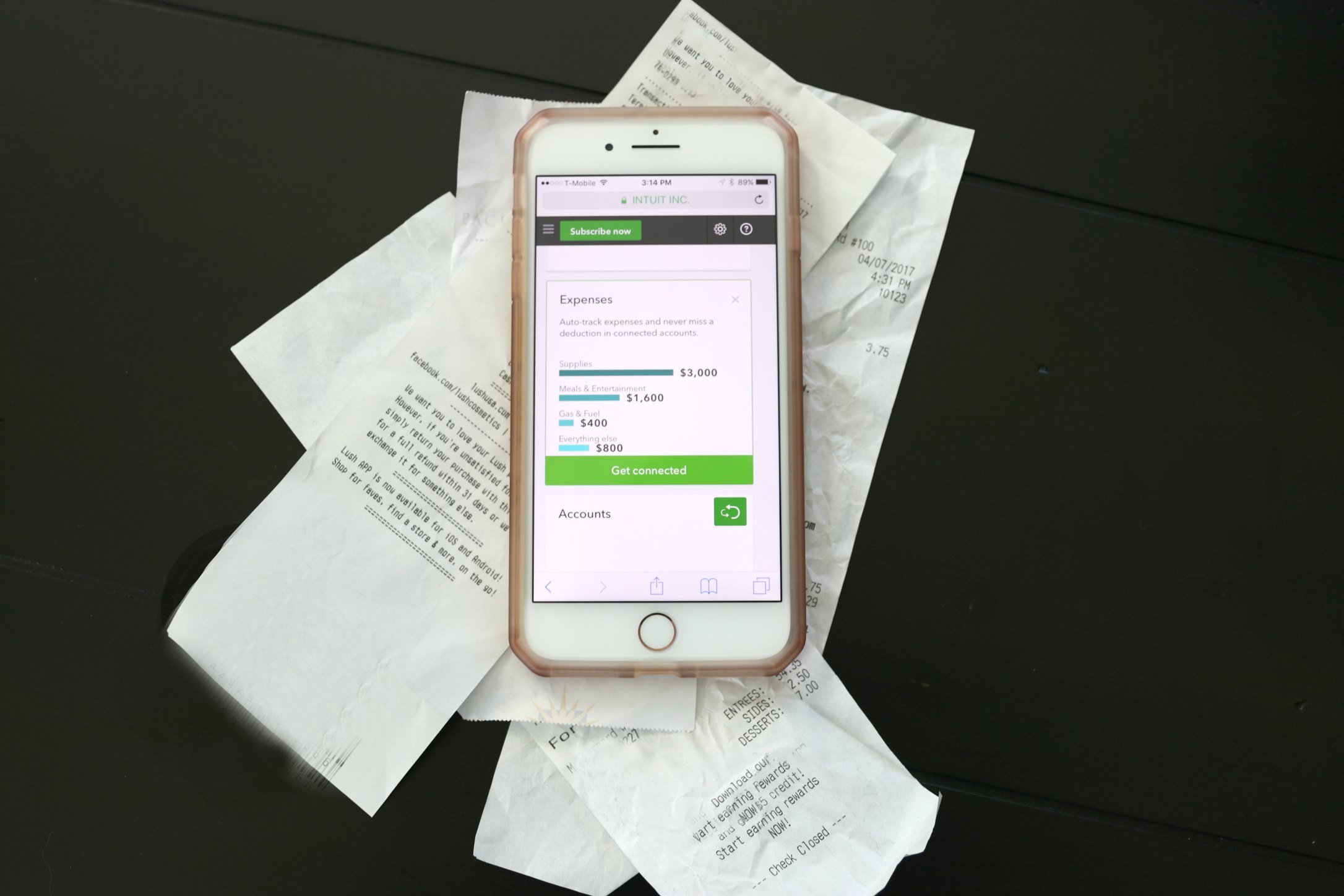

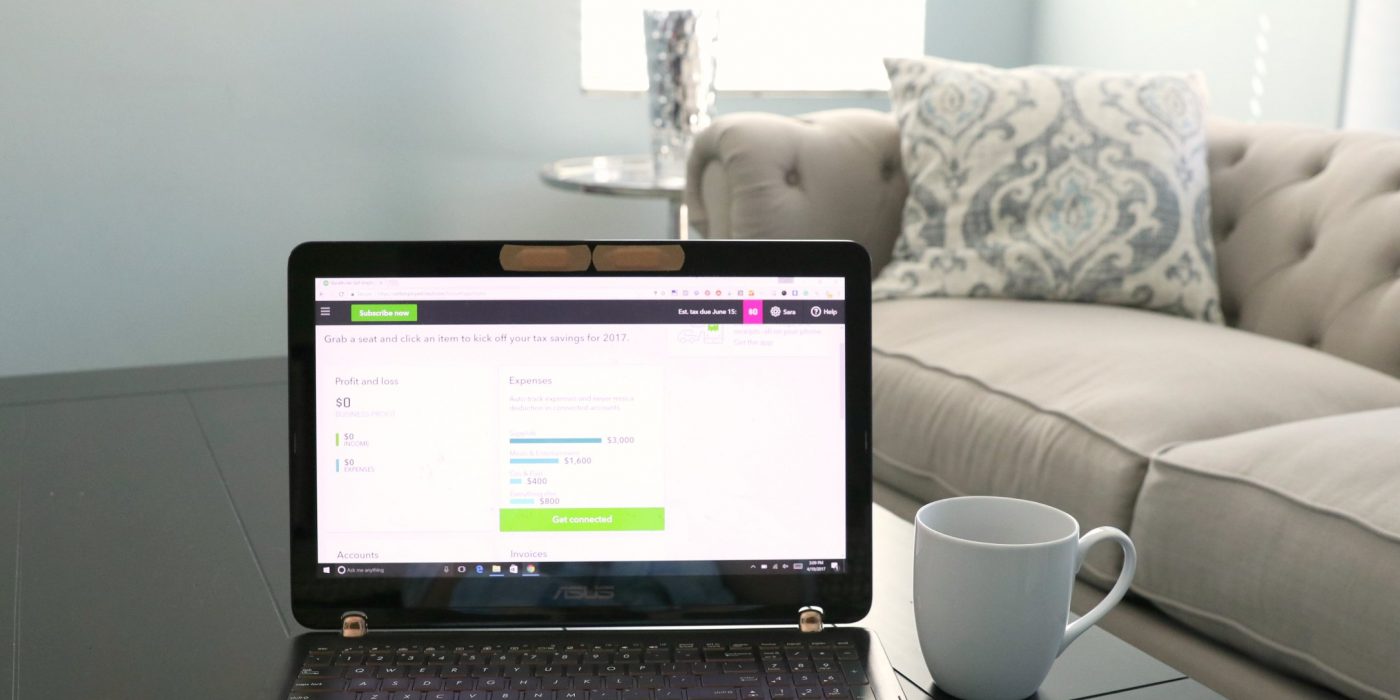

That means that when it is time to work, we are all in. Then, when it is time to play we go all out then too. We also learned that there are tools that overlap work and play time that helps us maximize both. One of our favorites, especially since we still have taxes on our mind, is QuickBooks Self-Employed.

QuickBooks Self-Employed is our “everything” when it comes to our business finances. It helps us find tax deductions, keeps our finances organized by capturing receipts for our business expenses, automatically tracks our mileage, and categorizes our business expenses for us.

It is specially designed for freelancers, independent contractors and Self-Employed individuals who receive a 1099, and file Schedule C’s. QuickBooks Self-Employed will help you maximize your tax deductions and put more money in your pocket. Plus, is does it all very intuitively and is easy to use no matter where in the world we are or what we are doing. That way we can spend more time on what is important to us…our family.

I know there are a lot of self-employed families out there that value their time like we do that would really benefit by leaving it to QuickBooks Self-Employed to automatically track business expenses, log, and track mileage and estimate your quarterly taxes so you don’t have to. Think of the time that would free up and where you could spend that time. That equals more family time and/or more time making more money!

I use QuickBooks Self-Employed on my laptop and from my mobile phone but I feel like it is always working for me even when I’m not actively logged in and using it. With most users, finding an average of $4,340 in potential tax savings per year and an average of $18,967 in deductions per year, I know that I am maximizing my money. At tax time their customers find tax deductions that could cut their tax bill by 36% too! That is billions in potential deductions found and hundreds of millions in potential tax savings found.

It is the perfect way to give yourself a raise.

Customers on average put 8% of their annual income back in their pocket using QuickBooks Self-Employed. When every dollar counts, 8% is an even bigger number than it sounds like!

One thing I have struggled with over the years is keeping track of mileage deductions.

I’m not alone in this either and I learned it is all about having a system and program that works. QuickBooks Self-Employed has helped users log in and deduct hundreds of millions of miles. On average, customers log $7,393 in mileage deductions per year. That is a huge deduction I know I don’t want to miss. On average customers log $616 in mileage deductions per month and find on average 45% more deductions by logging miles.

We work everywhere, even on the beach in Jamaica drinking strawberry smoothies, but we also have a home office back at home. QuickBooks Self-Employed knows about home office deductions and helps you maximize this too, with over $71 million in potential home office deductions found! On average, it finds $819 in home office deductions.

We have learned over the years that to be successful in any business, you have to have the right tools and surround yourself with the right people. Once you identify these prime members of your “team” you can focus on making money. QuickBooks Self-Employed is one of those tools that once you start using it, and you see how easy it is to use, it helps you make more and save more. It will quickly become a power player in your business life too!

Learn more about QuickBooks Self-Employed on Facebook, Twitter, and Instagram and by using these hashtags: #Quickbooks #SelfEmployed.

We have quickbook in the UK but it it mainly for business accounting. I do not know if they have this type of quickbook in the UK but I’d definitely use it. Looks very helpful!

Working from the beach in Jamaica sounds incredible! I would love to have this lifestyle.

Yes – you totally nailed it. The right tools are major in being efficient in your time. But – also knowing the right people make a difference. Lots to consider… thanks for the Quickbooks tool idea!

I’ve heard many bloggers and self employed using these programs. I tried it back in the day and it was too confusing for me.

I am making a concerted effort to keep track of mileage expenses now too after doing our taxes and realizing I hadn’t taken a advantage of the deductions I was allowed.

I use Quickbooks to manage my business but had no idea there was a specific version for self employed. Will have to ask my CPA if I should switch over.

I love the pictures and the beach calls my name to give myself a break lol I gotta try Quickbook tool then and thanks for the advice I need to surround myself with positive energy as well!

I travel for my day job and this would keep all the expenses in one place. Love this and will investigate more!

I don’t use quickbooks but definitely need to! It’s a great way to manage your business!

Oh, I really need this in my life. Especially since I have two businesses, my blog and a catering company. I tend to spend a lot on gear and other things and never know how to deduct it. Thank you for this!

I am always amazed at what QuickBooks can do. It really does make a difference when you are self employed. It is a great resource to keep track of all those crazy self employed finances which can be so hard to keep organized. Very helpful!

What a good post and this is the first t time that I heard about QuickBooks and this is so Interesting for me

Self-employed people need to use QuickBooks to keep track of their expenses and more! It will surely help them to keep organized!

This is such an informative article and QuickBooks sounds like must have for any business owner.

I went back to working for myself this month and need to get this right away. I am glad it is easy to use since time is money now!

I should look into quick books! You guys are seriously an inspiration for me! I hope I can get this well off soon!

I’ve heard of Quickbooks in the UK but I don’t think it is as accessible to smaller businesses in this way! I will have to check it out!

I have never heard of this version of Quickbooks!!! I really need to check it out, it’s something I am looking for right now!

I think I could really get use out of this. I need to keep better track of everything and it sounds like this could help.

QuickBooks seems so useful and interesting! Definitely want to use it, seems to help a lot!

gonna try that Quickbook! it looks very interesting and looks like something that i need!

This was a fantastic read. Thank you for breaking down what works for you and what you improved on. You made me realize I need Quickbooks in my life.

Yeah my husband uses QuickBooks and we like it. Great post.

I could really benefit for Quickbooks for Self Employed. I’m pretty good at keeping track of my invoices and money coming in, but I don’t do as good as job with where I could take deductions. This tool could really help me.

I have heard good things about Quick Books. I need to look into this – especially if it is in app form, since that would really streamline things.

I should look into this. It makes sense for freelancers to have it.

It’s my first time to hear about Quickbook self employed but it sounds like just the right thing I need! I will try it out and see if it works for me.

I’ve been wanting to try out Quickbooks for my blog. It sounds like a great phone app!

Great Post! Sounds like a great to use for keeping my finances organize.

I think QuickBooks is an awesome app to have. I also work from home and sometimes the household chores get in the way of keeping finances in check. I will give this a try and see how it works for me.

I think Quickbooks would be great. We need to try this for both our businesses. It seems like a great program to use!

Yay for a raise! This sounds like a great app to stay organized over the year.

Wow I had no idea this even existed. I need this. Thanks for sharing!!

I have to give myself some time to read through Quickbooks Self Employed. I think it is going to make minding my finances easier. Thanks for letting me know.

I’ve heard such good things about this! Especially as a blogger, it could really come in handy. We use Quick Books but I don’t think we have that version yet.

This is great advice for those who need the extra tool to make sure their spending and expenses are fully accounted for. I’m familiar with this software.

We just started our membership with QuickBooks Self-Employed. We already use TurboTax, so it made the most sense in tracking all of my online income.

That’s great! It will make life (and business) so much easier!

It’s really all about working hard and being dedicated to what you do. It’s also important to allow yourself to have some down time. It looks like you found which works.

It’s nice that you found a guide that works for you through quickbooks. I think it’s really important that you utilize all the tools that can help you become more successful.

I need to look into this it’s about that time! Ty for sharing ❤️

QuickBooks looks like an amazing tool for self-employed people! I’ll share it with all my self-employed friends!

Taxes are a nightmare for us and we are still working on it. This tool would really help me!